IP-enabled CE: boon for chips?

EETimes

http://www.eetimes.com/showArticle.jhtml;jsessionid=HWVVLMJFAIVEMQSNDLRSKH0CJUNN2JVN?articleID=206903648

03-14-08, By Mark Kirstein

A semiconductor market starts getting serious attention when it can be measured in the billions of dollars. The market for semiconductors that enable Internet Protocol connectivity in consumer electronics will soon cross that threshold.

With more than 60 million IP-enabled consumer electronics devices shipped into the market in 2007, the semiconductors underlying that connectivity already represent more than $560 million in annual revenues. The total includes the media-access control (MAC), physical interface (PHY) and related support chips.

By 2012, as consumer electronics manufacturers and operators gradually add IP connectivity across a broad array of equipment, MultiMedia Intelligence sees the market for the resulting network interface semiconductors growing to nearly $2.5 billion.

Videogame consoles still constitute the largest percentage of IP-enabled devices. This is more than just an idle connection. Based on consumer responses, more than 5 million consumers play videogames over the Web--and Internet-connected consoles are reaching beyond gaming. In late 2007, Activision announced it had sold more than 2 million songs associated with its Guitar Hero game through Xbox live over the previous five months.

Now an increasing variety of TV-centric consumer electronics devices with IP interfaces is arising. Manufacturers are adding Internet interfaces across TVs, DVD equipment and set-top boxes. Those connections will not only serve as gateways to the Internet, but will also enable sharing of digital video, music and images among devices within the home.

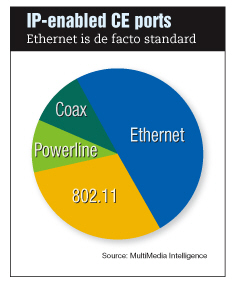

At the physical connection layer, there are multiple connectivity choices, including wired Ethernet, 802.11/Wi-Fi, coax and powerline. These vary by geographic region and by box type. While there is vibrant com- petition to drive the market toward a favored connectivity technology, the reality is that most consumer devices will have multiple connectiv- ity options.

The ubiquity and low cost of wired Ethernet will allow it to continue to be the most popular interface, as the de facto standard in nearly all Internet-enabled consumer electronics. Even devices with other interfaces will likely still have at least one Ethernet connection as a default, as well as for testing or software installation during manufacturing.

Powerline and coax adoption will largely reflect geographic location. While coax has a time-to-market advantage for operator-centric video distribution and multiroom DVR, powerline has a larger global appeal. Wireless will be used for connectivity with mobile devices, enabling direct Internet access and data transmission. Wi-Fi also may support nonlinear or cached video.

Within the major physical connectivity categories, there is competition among standards. The Multimedia over Coax Alliance (MoCA) and HomePNA are vying for dominance in the coax space, with the High-Definition Audio-Video Network Alliance (HANA) spec fighting for an entry point as the demands of high definition drive new bandwidth and quality-of-service requirements. Powerline technologies include the alternatives pitched by the Consumer Electronics Powerline Communications Alliance (CEPCA), HomePlug and the Universal Powerline Association (UPA).

The growing market for network interfaces is garnering attention from a widening field of semiconductor companies. Competitors range from relatively focused and growing entities, such as Coppergate, DS2, Entropic Communications and Intellon, to established competitors such as Atheros, Broadcom, Conexant, Intel and Texas Instruments.

Some companies are demonstrating rapid growth, reflecting the rising opportunities in Internet Protocol-enabled consumer devices:

Such growth rates are becoming more difficult to find in the overall semiconductor market, making chips for IP-enabled gear an attractive market for newcomers and established companies alike.

Mark Kirstein is president of MultiMedia Intelligence (Scottsdale, Ariz.), a market research and consulting firm.